Subscribe to our ▶️YouTube channel🔴 for the latest videos, updates, and tips.

Home | About Us | Contact Us | Privacy | Math Blog

Profit Loss Involving Tax

We will discuss here how to solve the problems based on Profit loss involving tax.

1. A shopkeeper buys a DVD player at a rebate of 20% on the printed price. He spends $ 20 on transportation of the DVD player. After changing a sales tax 6% on the printed price, he sells the DVD player at $530. Find his profit percentage.

Solution:

Let the printed price be P. Then, the cost price = P – 20% of P

= P – 20P100

= 4P5.

Actual cost price including transportation cost = 4P5 + $ 20.

The sales tax = 6% of P = 6P100 = 3P50

Therefore, the selling price including sales tax = P + 3p50

According to the problem,

P + 3P50 = 53P50 = $ 530

53P50 = $ 530

Therefore, P = $ 500

Therefore, the actual cost price = 4P5 + $ 20 = 4×$5005 + $ 20 = $ 420.

Therefore, profit = printed price – actual cost price = $ 500 - $ 420 = $ 80.

Therefore, profit percentage = $80$420 × 100% = 40021% = 19121 %.

2. A seller buys a LED Televisions for $ 2500 and marks up its price. A customer buys the LED Televisions for $ 3,300 which includes a sales tax of 10% on the marked up price.

(i) Find the mark-up percentage on the price of the LED Televisions.

(ii) Find his profit percentage.

Solution:

Let the marked up price be P. Then, the sales tax = 10% of P = P/10.

Therefore, selling price = P + P10

According to the problem, = $ 3300

Or, P ∙ 1110 = $ 3300

Therefore, P = $ 3000.

Therefore, $ 2500 is marked up to $ 3000

Therefore, mark-up percentage = $300−$25002500 × 100%

= 5002500 × 100%

= 20%

Now, the profit = marked up price – cost price = $ 3000 - $ 2500 = $ 500

Therefore, profit percentage = $500$2500 × 100% = 20%

● Sales Tax and Value Added Tax

- Calculation of Sales Tax

- Sales Tax in a Bill

- Mark-ups and Discounts Involving Sales Tax

- Profit Loss Involving Tax

- Value Added Tax

- Problems on Value Added Tax (VAT)

- Worksheet on Printed Price, Rate of Sales Tax and Selling Price

- Worksheet on Profit/Loss Involving Sales Tax

- Worksheet on Sales Tax and Value-added Tax

- Worksheet on Mark-ups and Discounts Involving Sales Tax

From Profit Loss Involving Tax to HOME PAGE

Didn't find what you were looking for? Or want to know more information about Math Only Math. Use this Google Search to find what you need.

Recent Articles

-

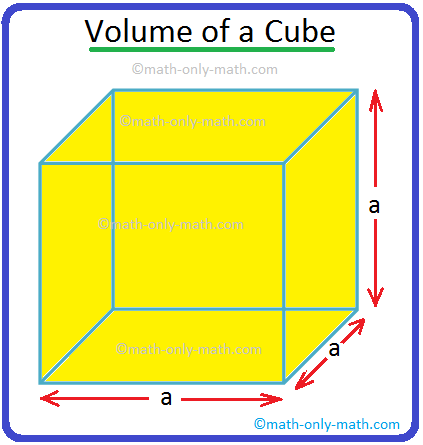

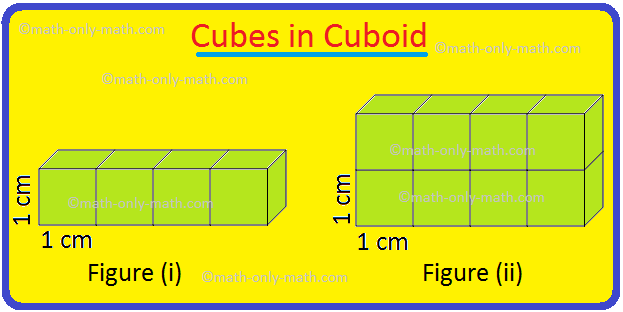

Volume of a Cube | How to Calculate the Volume of a Cube? | Examples

Jul 23, 25 11:37 AM

A cube is a solid box whose every surface is a square of same area. Take an empty box with open top in the shape of a cube whose each edge is 2 cm. Now fit cubes of edges 1 cm in it. From the figure i… -

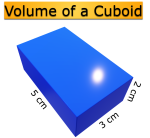

Volume of a Cuboid | Volume of Cuboid Formula | How to Find the Volume

Jul 20, 25 12:58 PM

Cuboid is a solid box whose every surface is a rectangle of same area or different areas. A cuboid will have a length, breadth and height. Hence we can conclude that volume is 3 dimensional. To measur… -

5th Grade Volume | Units of Volume | Measurement of Volume|Cubic Units

Jul 20, 25 10:22 AM

Volume is the amount of space enclosed by an object or shape, how much 3-dimensional space (length, height, and width) it occupies. A flat shape like triangle, square and rectangle occupies surface on… -

Worksheet on Area of a Square and Rectangle | Area of Squares & Rectan

Jul 19, 25 05:00 AM

We will practice the questions given in the worksheet on area of a square and rectangle. We know the amount of surface that a plane figure covers is called its area. 1. Find the area of the square len… -

Area of Rectangle Square and Triangle | Formulas| Area of Plane Shapes

Jul 18, 25 10:38 AM

Area of a closed plane figure is the amount of surface enclosed within its boundary. Look at the given figures. The shaded region of each figure denotes its area. The standard unit, generally used for…

New! Comments

Have your say about what you just read! Leave me a comment in the box below. Ask a Question or Answer a Question.