Subscribe to our ▶️YouTube channel🔴 for the latest videos, updates, and tips.

Home | About Us | Contact Us | Privacy | Math Blog

Calculation of Sales Tax

The calculation of sales tax is very easy as it involves very simple concept of percentage.

The government of every country needs money the following:

(i) to meet their administrative expenses,

(ii) to execute social welfare and development schemes,

(ii) to meet the expenses on salaries of its employees, etc.

One of the many sources of collecting money (revenue) by the government from the citizen on the sale of goods within their respective territories. This purpose is known as sales tax.

It is levied by a government on the sale of different commodity. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it.

The rates of tax on purchase of different commodities within

a country are different. Also, the rates of tax on the same commodity in

different country are different. Some commodities may be be exempted from sales

tax by a government. Sales tax is one of the many forms of indirect taxes that

a government imposes on its citizens.

If P be the printed price or marked price of a commodity, the rate of sales tax be r% and S be the selling price (i.e., the price a customer has to pay) then

S = P(1 + r100) and sales tax = S - P = Pr100

Solved examples on relation between printed price, rate of sales tax and selling price:

1. The printed price of a bi-cycle is $ 4200. The rate of sales tax on it is 10%. Find the price at which the cycle can be purchased.

Solution:

Here, the printed price P = $ 4200, the rate of sales tax = 10%, i.e. r = 10

Therefore, the selling price S = P(1 + r100)

= $ 4200 × (1 + 10100)

= $ 4200 × 1110

= $ 4620

Therefore, the cycle can be purchased for $ 4620.

3. Mason purchased a pair of shoes costing $ 850. Calculate the total amount to be paid by him, if the rate of Sales Tax is 6%.

Solution:

The sale price of shoes = $ 850

and, the sales tax = 6 % of $ 850 = $ 51

Therefore, the total amount to be paid by Rohit = $ 850 + $ 51 = $ 901

4. John bought a printing machine for $5136, which includes sales tax. If the listed price of the printing machine is $ 4800, what was the rate of sales tax?

Solution:

Here, the printed price (or listed price) P = $ 4800, the selling price S = $ 5136.

If the rate of sales tax be r% then,

S = P(1 + r100)

⟹ $ 5136 = $ 4800(1 + r100)

⟹ 1 + r100 = 51364800

Therefore, r100 = 51364800 - 1

⟹ r100 = 3364800

⟹ r = 33648

⟹ r = 7.

Therefore, the rate of sales tax was 7%.

5. Jacob purchased an article for $ 702 including Sales Tax. If the rate of Sales Tax is 8%, find the sale price of the article.

Solution:

Let the sale price of the article be $ x

Therefore, x + 8% of x = $ 702

⟹ x + 8x100 = $ 702

⟹ 108x100 = $ 702

⟹ x = $ 702 × 100108

⟹ x = $ 650

Therefore, sale price of the article = $ 650

6. Find the marked price of a motorbike which is bought at $ 36300 after paying a sales tax at the rate of 10%.

Solution:

Here, the marked price or listed price P, the selling price S = $ 36300 and the rate of sales tax = 10%, i.e. r = 10

S = P(1 + r100)

⟹ $ 36300 = P(1 + 10100)

⟹ P × 1110 = $ 36300

⟹ P = $ 36300 × 1011

⟹ P = $ 3300 × 10

⟹ P = $ 33000

Therefore, the marked price is $ 33000.

4. A refrigerator is marked for sale at $ 17600 inclusive of sales tax at the rate of 10%. Calculate the sales tax on the refrigerator.

Solution:

Let the price of the refrigerator without sales tax = P.

Here, the selling price S = $ 17600 and the rate of sales tax i.e., r = 10

S = P(1 + r100)

⟹ $ 17600 = P(1 + 10100)

⟹ P ∙ 1110 = $ 17,600

Therefore, P = $17,600 × 1110 = $ 16,00 × 10 = $ 16,000

Therefore, the sale tax = Selling price - Printed price

= $ 17,600 - $ 16,000

= $ 1,600

5. If the rate of sale tax increases by 55, the selling price of an article goes up by $ 40. Find the marked price of the article.

Solution:

Let the marked price = P(1 + r100)

When the rate of sales tax increases by 5%,

the selling price = p(1 + r+5100)

From the equation, P(1 + r+5100) – P(1 + r100) = $ 40

⟹ 5P100 = $ 40

⟹ P = $ 40 × 20 = $ 800

Therefore, the marked price of the article is $ 800.

● Sales Tax and Value Added Tax

- Calculation of Sales Tax

- Sales Tax in a Bill

- Mark-ups and Discounts Involving Sales Tax

- Profit Loss Involving Tax

- Value Added Tax

- Problems on Value Added Tax (VAT)

- Worksheet on Printed Price, Rate of Sales Tax and Selling Price

- Worksheet on Profit/Loss Involving Sales Tax

- Worksheet on Sales Tax and Value-added Tax

- Worksheet on Mark-ups and Discounts Involving Sales Tax

10th Grade Math

From Calculation of Sales Tax to HOME PAGE

Didn't find what you were looking for? Or want to know more information about Math Only Math. Use this Google Search to find what you need.

Recent Articles

-

Worksheet on Area of a Square and Rectangle | Area of Squares & Rectan

Jul 19, 25 05:00 AM

We will practice the questions given in the worksheet on area of a square and rectangle. We know the amount of surface that a plane figure covers is called its area. 1. Find the area of the square len… -

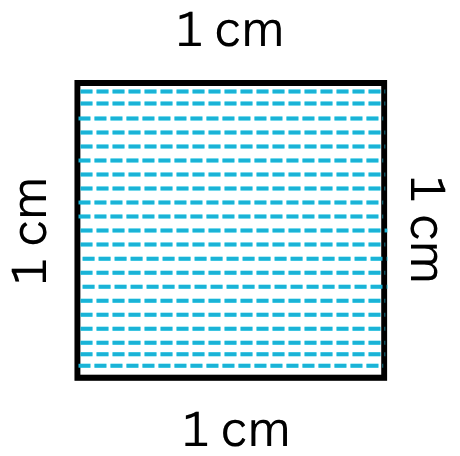

Area of Rectangle Square and Triangle | Formulas| Area of Plane Shapes

Jul 18, 25 10:38 AM

Area of a closed plane figure is the amount of surface enclosed within its boundary. Look at the given figures. The shaded region of each figure denotes its area. The standard unit, generally used for… -

What is Area in Maths? | Units to find Area | Conversion Table of Area

Jul 17, 25 01:06 AM

The amount of surface that a plane figure covers is called its area. It’s unit is square centimeters or square meters etc. A rectangle, a square, a triangle and a circle are all examples of closed pla… -

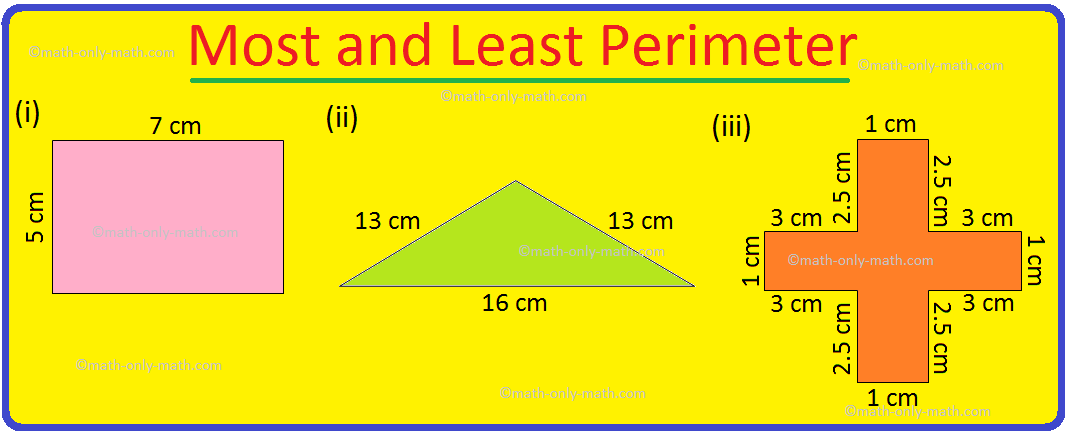

Worksheet on Perimeter | Perimeter of Squares and Rectangle | Answers

Jul 17, 25 12:40 AM

Practice the questions given in the worksheet on perimeter. The questions are based on finding the perimeter of the triangle, perimeter of the square, perimeter of rectangle and word problems. I. Find… -

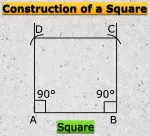

Formation of Square and Rectangle | Construction of Square & Rectangle

Jul 16, 25 11:46 PM

In formation of square and rectangle we will learn how to construct square and rectangle. Construction of a Square: We follow the method given below. Step I: We draw a line segment AB of the required…

New! Comments

Have your say about what you just read! Leave me a comment in the box below. Ask a Question or Answer a Question.